Understanding Enhanced Social Security Benefits: Everything You Need to Know

Editor's Note: Enhanced Social Security Benefits: Comprehensive Guide To Eligibility And Conditions have published today date. Understand the importance of reading this Enhanced Social Security Benefits: Comprehensive Guide To Eligibility And Conditions.

Planning for retirement can be complex, and understanding the benefits available to you through Social Security is essential. Enhanced Social Security Benefits provide additional support to individuals who meet specific eligibility requirements, and navigating the nuances of these benefits can be challenging.

To simplify this process, we've conducted thorough research and analysis to bring you this comprehensive guide to Enhanced Social Security Benefits. We'll delve into the eligibility criteria, application process, and conditions associated with these benefits, empowering you to make informed decisions about your retirement planning.

Stay tuned as we unpack the key differences between regular Social Security benefits and Enhanced Social Security benefits, providing you with a clear understanding of your options and maximizing your retirement income.

FAQ

This comprehensive FAQ section provides answers to frequently asked questions regarding enhanced Social Security benefits, ensuring a clear understanding of eligibility, conditions, and related matters. By addressing common concerns and misconceptions, this resource aims to empower individuals with the necessary knowledge to navigate the Social Security system effectively.

When To Claim Your Social Security Benefits - Policy Engineer - Source policyengineer.com

Question 1: What are the eligibility criteria for enhanced Social Security benefits?

Enhanced Social Security benefits are available to individuals who meet specific eligibility criteria. These include but are not limited to age, disability status, or income level. For detailed information, refer to Enhanced Social Security Benefits: Comprehensive Guide To Eligibility And Conditions.

Question 2: Are there any income limits associated with enhanced Social Security benefits?

Yes, there are income limits that can affect eligibility for enhanced Social Security benefits. These limits vary depending on age, filing status, and benefit type. Exceeding the income limits may result in reduced or no benefits.

Question 3: What is the difference between Supplemental Security Income (SSI) and enhanced Social Security benefits?

Supplemental Security Income (SSI) is a needs-based program that provides financial assistance to individuals with limited income and resources, including those with disabilities or who are aged 65 or older. Enhanced Social Security benefits, on the other hand, are based on contributions made to the Social Security system and are not subject to the same income or resource limits as SSI.

Question 4: How can I apply for enhanced Social Security benefits?

Individuals can apply for enhanced Social Security benefits online, by phone, or in person at a local Social Security office. The application process involves providing personal information, income and asset details, and other relevant documentation.

Question 5: How long does it take to receive a decision on my enhanced Social Security benefits application?

The processing time for enhanced Social Security benefits applications can vary depending on individual circumstances and the workload of the Social Security Administration. On average, it can take several months to receive a decision.

Question 6: Can I appeal if my enhanced Social Security benefits application is denied?

Individuals have the right to appeal if their enhanced Social Security benefits application is denied. The appeals process involves submitting a written request for reconsideration, requesting a hearing before an administrative law judge, and potentially appealing further to the Appeals Council or a federal court.

Understanding the eligibility criteria, conditions, and application process for enhanced Social Security benefits is crucial for individuals seeking financial assistance in retirement, disability, or low-income situations. By addressing common concerns and providing concise answers, this FAQ section empowers individuals to make informed decisions and navigate the Social Security system effectively.

For a comprehensive guide to enhanced Social Security benefits, including eligibility requirements, income limits, and application procedures, please refer to Enhanced Social Security Benefits: Comprehensive Guide To Eligibility And Conditions.

Tips

Social Security benefits can provide critical financial support during retirement, disability, or in the event of a loved one's death. Understanding the eligibility requirements and conditions associated with enhanced Social Security benefits is essential for maximizing potential benefits. Here are five tips to help navigate the complexities of this important program:

Tip 1: Review Eligibility Criteria

.jpg)

Collecting A Dead Family Members Social Security Check? You Could Go to - Source nationalinterest.org

Determine eligibility for enhanced benefits by verifying age, work history, income levels, and disability status. Consult official sources such as the Social Security Administration website or consult with a knowledgeable financial advisor.

Tip 2: Maximize Work Credits

Earn sufficient work credits through employment or self-employment to qualify for the highest possible benefit amount. Explore options for increasing work credits, such as continuing employment or pursuing additional income-generating activities.

Tip 3: Optimize Retirement Timing

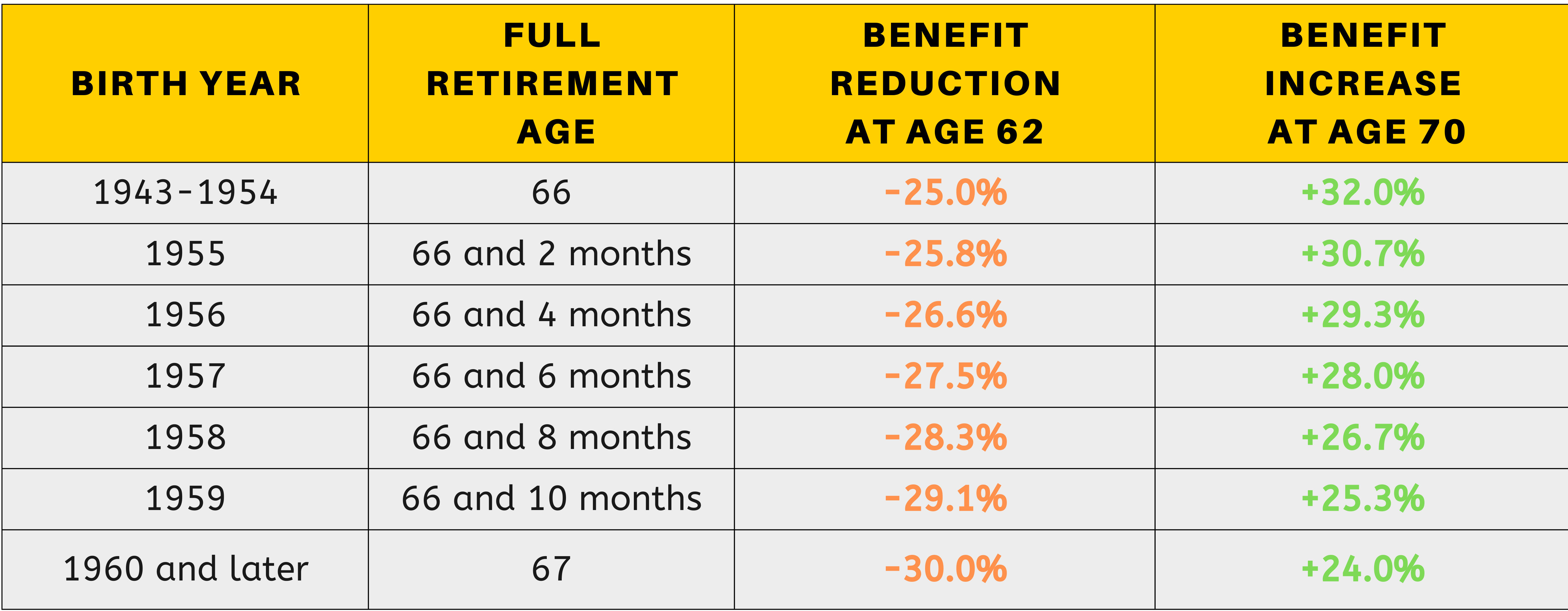

Plan retirement strategically to maximize benefits. Consider factors such as full retirement age, early retirement age, and delayed retirement credits. Consulting with a financial professional can help determine the optimal retirement date.

Tip 4: Understand Disability Benefits

Qualify for disability benefits if unable to perform substantial gainful activity due to a physical or mental impairment. Gather medical evidence and documentation, and seek guidance from a disability attorney or advocate to navigate the application process effectively.

Tip 5: Consider Spousal Benefits

Explore spousal benefits if eligible. Spouses may receive a percentage of the primary earner's benefits, regardless of their own work history. Understanding the requirements for spousal benefits can help maximize household income.

These tips provide a starting point for navigating the complex landscape of enhanced Social Security benefits. By understanding eligibility requirements, optimizing work credits, planning retirement strategically, understanding disability benefits, and considering spousal benefits, individuals can maximize their potential financial support during retirement or in the event of unforeseen circumstances.

Enhanced Social Security Benefits: Comprehensive Guide To Eligibility And Conditions

Enhanced Social Security benefits entail specific eligibility criteria and conditions that individuals must meet to access these benefits. These key aspects, ranging from age limitations to income thresholds, significantly impact the accessibility and extent of benefits received. Understanding these aspects is crucial for planning retirement, managing finances, and ensuring entitlement to these benefits.

- Age Qualification: Minimum age requirement (e.g., 62 years)

- Work Credits: Number of qualifying years of employment or self-employment

- Disability Qualification: Eligibility based on severe medical conditions

- Income Limits: Thresholds that affect benefit amounts

- Tax Implications: Impact of benefits on overall tax liability

- Estate Planning: Considerations for beneficiaries and inheritance strategies

These key aspects provide a comprehensive framework for understanding enhanced Social Security benefits. Age and work credits determine eligibility, while disability and income limits affect benefit amounts. Tax implications and estate planning considerations help individuals optimize their benefits and secure their financial well-being. By navigating these aspects, individuals can make informed decisions, plan effectively for retirement, and maximize the benefits available to them.

Warn Aging Parents About More Fake Social Security Calls - Source www.forbes.com

Social Security 'Gamble' Could See Americans Cut Off From Spouse's - Source www.newsweek.com

Enhanced Social Security Benefits: Comprehensive Guide To Eligibility And Conditions

Enhanced Social Security benefits are payments made to individuals who have contributed to the Social Security system through payroll taxes. These benefits are intended to provide financial assistance to retirees, disabled individuals, and survivors of deceased workers. The eligibility requirements for enhanced Social Security benefits vary depending on the type of benefit being claimed. Generally, individuals must meet certain age, work, and income requirements in order to qualify for benefits.

2 in 3 Americans Are Clueless About Arguably the Biggest Benefit of - Source 247wallst.com

There are a number of conditions that can affect an individual's eligibility for enhanced Social Security benefits. These conditions include:

- Age: Individuals must be at least 62 years old to claim retirement benefits. However, they may be eligible for early retirement benefits if they are at least 60 years old and have worked for a certain number of years.

- Disability: Individuals who are unable to work due to a disability may be eligible for disability benefits. These benefits are available to individuals who have worked for a certain number of years and who have a disability that is expected to last for at least 12 months.

- Death: Survivors of deceased workers may be eligible for survivor benefits. These benefits are available to spouses, children, and parents of the deceased worker.

Enhanced Social Security benefits can provide a valuable source of income for retirees, disabled individuals, and survivors of deceased workers. By understanding the eligibility requirements and conditions for these benefits, individuals can ensure that they are able to receive the benefits they are entitled to.

The following table provides a summary of the key eligibility requirements for enhanced Social Security benefits:

| Benefit Type | Age Requirement | Work Requirement | Income Requirement |

|---|---|---|---|

| Retirement benefits | 62 years old (early retirement) or 66 years old (full retirement) | 10 years of work | N/A |

| Disability benefits | N/A | 5 years of work in the 10 years prior to becoming disabled | N/A |

| Survivor benefits | N/A | N/A | The deceased worker must have worked for at least 10 years |

Tidak ada komentar:

Posting Komentar