Confused about the complexity of gold prices? "Today's Gold Prices: Real-Time Market Updates And Analysis" may help!

In this article, we will explore the importance of "Today's Gold Prices: Real-Time Market Updates And Analysis", discuss the key differences between different gold products, and provide you with the information you need to make informed decisions about buying or selling gold.

Key Differences

There are a few key differences between different gold products. These differences include:

Purity: The purity of gold is measured in karats. 24-karat gold is the purest form of gold, while 18-karat gold is 75% gold and 25% other metals.

Form: Gold can be purchased in a variety of forms, including coins, bars, and jewelry.

Price: The price of gold is determined by a number of factors, including the spot price of gold, the demand for gold, and the supply of gold.

Transition to main article topics

FAQ

Seeking answers to frequently asked questions about the gold market can help you make informed decisions. Today's Gold Prices: Real-Time Market Updates And Analysis provides real-time market data and insights, and this FAQ can supplement that information by addressing common misconceptions and concerns.

Uncover the role played by SMS in trading and stock market | D7 Networks - Source d7networks.com

Question 1:

What factors influence the price of gold?

Answer: Gold prices fluctuate based on supply and demand dynamics. Economic factors, political instability, inflation concerns, and central bank policies can all influence market sentiment and drive price movements.

Question 2:

Is it better to invest in physical gold or gold ETFs?

Answer: The choice depends on investment objectives and risk tolerance. Physical gold offers tangible ownership but requires storage considerations, while gold ETFs provide diversification and liquidity but may involve management fees.

Question 3:

What is the difference between gold bullion and gold coins?

Answer: Gold bullion refers to high-purity gold bars, while gold coins are typically minted by governments or private mints and may have collector's value or numismatic significance.

Question 4:

How do I determine the purity of gold?

Answer: Gold purity is measured in karats (K). Pure gold is 24K, while 18K gold is 75% pure and 14K gold is 58.3% pure. Hallmarks or certificates from reputable dealers can indicate the gold's purity.

Question 5:

What is the role of gold in a diversified investment portfolio?

Answer: Gold can act as a safe haven asset during market downturns, potentially providing diversification benefits and reducing overall portfolio risk.

Question 6:

How do I stay informed about gold market trends?

Answer: Monitor reputable financial news sources, follow industry experts on social media, and explore resources such as Today's Gold Prices: Real-Time Market Updates And Analysis to stay updated on market movements and analysis.

Understanding these aspects of the gold market can empower you to make informed decisions and navigate market fluctuations more effectively.

Proceed to the Next Section:Understanding the Gold Market Dynamics

Tips

Tips to Make the Most of Today's Gold Prices:

Tip 1: Track Market Trends: Monitor real-time gold prices to identify trends and patterns. Use reputable sources like Kitco, GoldHub, or the World Gold Council for accurate data.

Tip 2: Research Historical Data: Analyze past price movements to gain insights into potential future trends. Understanding historical highs and lows can inform investment decisions.

Tip 3: Diversify Investments: Don't put all eggs in one basket. Spread investments across different asset classes, including gold, stocks, bonds, and real estate, to mitigate risk and optimize returns.

Tip 4: Consider Physical Gold: While investing in paper gold through ETFs or mutual funds is convenient, physical gold provides tangible ownership and may offer a hedge against inflation and economic uncertainty.

Tip 5: Use Gold as a Long-Term Asset: Gold has historically been a reliable long-term investment. Avoid short-term trading and focus on holding for the long haul.

Tip 6: Seek Professional Advice: Consult with a financial advisor or gold expert for personalized guidance and insights tailored to individual risk tolerance and financial goals.

Tip 7: Store Gold Securely: Whether investing in physical or paper gold, ensure secure storage to protect against theft or loss. Consider bank vaults or reputable storage facilities.

Tip 8: Monitor Market News: Stay informed about political, economic, and geopolitical events that can impact gold prices. Monitor news outlets and industry publications for relevant updates.

Remember, the gold market is complex and influenced by various factors. Careful research, diversification, and long-term investment strategies can help maximize potential returns.

Today's Gold Prices: Real-Time Market Updates And Analysis

The gold market is a complex and ever-evolving landscape, making it essential to stay informed about the latest price movements and market trends. Here are six key aspects to consider when analyzing today's gold prices:

- Spot prices: The current market price of gold, reflecting real-time supply and demand.

- Gold futures: Contracts traded on exchanges that lock in a price for future delivery.

- Physical demand: The physical buying and selling of gold bars, coins, and jewelry.

- Central bank activity: Gold purchases and sales by central banks can impact prices significantly.

- Economic indicators: Inflation, interest rates, and economic growth can influence gold prices.

- Geopolitical events: Political turmoil and global economic uncertainty can drive investors towards gold as a safe haven.

Understanding these key aspects provides a comprehensive foundation for analyzing today's gold prices. By considering the interplay between spot prices, futures contracts, physical demand, central bank activity, economic indicators, and geopolitical events, investors can make informed decisions and navigate the intricacies of the gold market effectively.

JMgb2types | CMI Gold & Silver - Source www.cmi-gold-silver.com

Today's Gold Prices: Real-Time Market Updates And Analysis

Gold prices are a key indicator of the overall health of the global economy. When the economy is strong, demand for gold typically increases, as investors seek a safe haven asset to protect their wealth. Conversely, when the economy is weak, demand for gold often decreases, as investors sell off their gold holdings to raise cash.

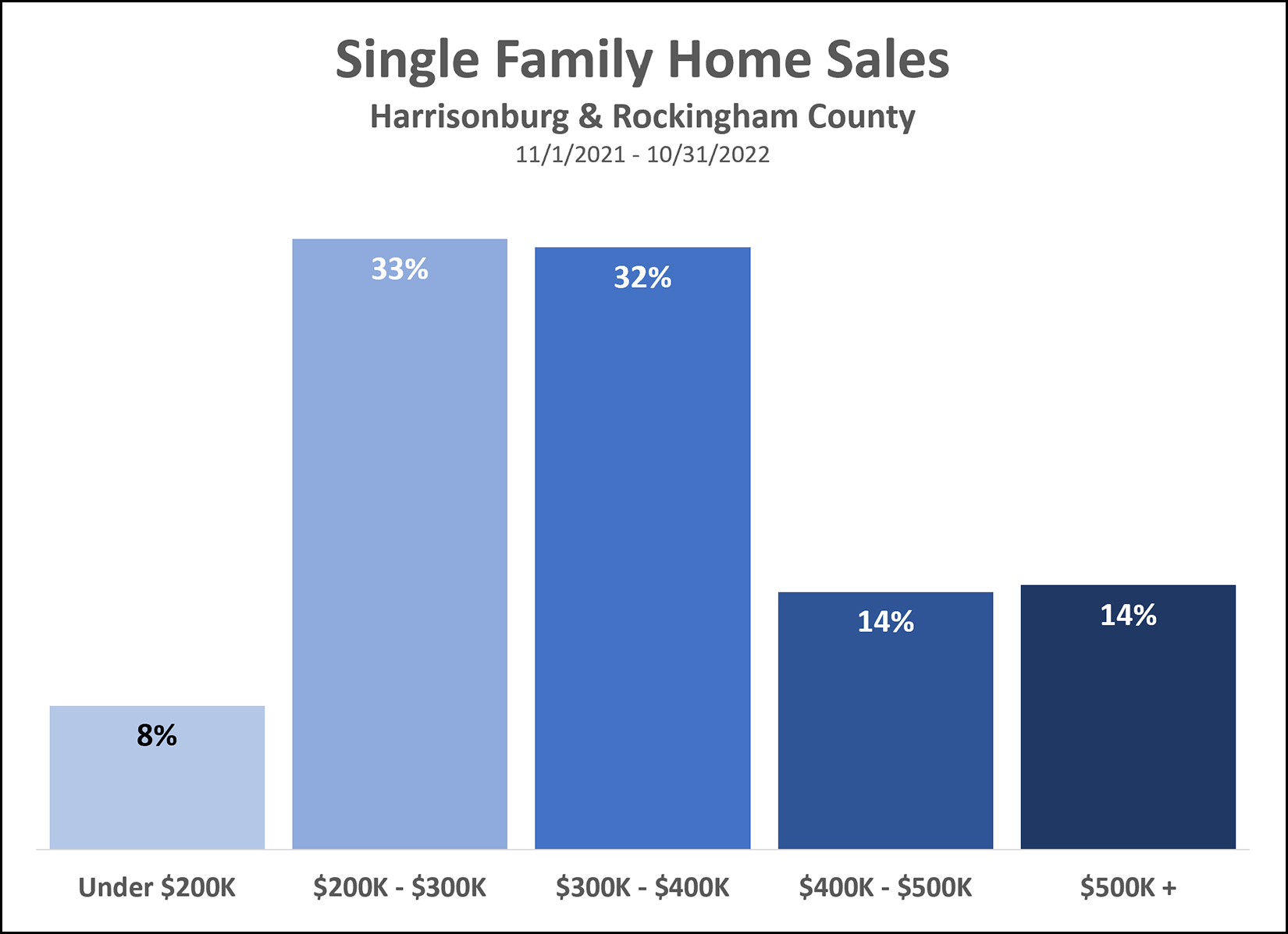

Fewer Than 10% Of Buyers Spend Less Than 0K On Single Family Homes - Source www.harrisonburghousingtoday.com

Real-time market updates and analysis are essential for investors who want to stay on top of the latest gold price movements. By tracking the latest news and events that could affect gold prices, investors can make informed decisions about when to buy and sell gold.

There are a number of factors that can affect gold prices, including:

- The strength of the US dollar

- The level of inflation

- The political and economic climate

- The supply and demand for gold

Investors who are interested in investing in gold should carefully consider all of these factors before making a decision.

Tidak ada komentar:

Posting Komentar