Designed to cater to your both personal and business financial needs, D360 Digital Banking is an innovative banking solution that provides a seamless and secure online banking experience.

Getting Your Personal Finances in Shape for 2019 - Source www.vermillionfinancial.com

Editor's Notes: D360 Digital Banking: Empowering Personal And Business Finances is a topic relevant to today's digitally-driven world. As a result of our extensive research and analysis, we have compiled this guide to assist you in making informed decisions regarding your financial management.

Below you will find the key differences between personal and business D360 Digital Banking accounts.

| Feature | Personal Account | Business Account |

|---|---|---|

| Account Management | Manage your personal finances | Manage your business finances |

| Transactions | Pay bills, transfer funds, and track expenses | Process payments, manage payroll, and track business expenses |

| Tools and Resources | Access to financial planning tools and calculators | Access to business-specific tools, such as invoicing and expense tracking |

| Security | Protected by advanced security measures | Enhanced security measures to protect sensitive business data |

With its user-friendly interface and robust features, D360 Digital Banking provides a convenient and efficient way to manage your finances. Whether you're looking to streamline your personal finances or enhance your business operations, D360 Digital Banking offers a comprehensive solution that meets your needs.

FAQ

This comprehensive guide provides answers to frequently asked questions regarding D360 Digital Banking: Empowering Personal And Business Finances.

Empowering Financial Freedom: Discover the Latest Technological - Source www.dreamstime.com

Question 1: What are the key features of D360 Digital Banking?

D360 Digital Banking offers a robust suite of features tailored to meet the needs of both personal and business clients. These include online and mobile banking, bill pay, account alerts, budgeting tools, financial planning capabilities, and much more.

Question 2: How does D360 Digital Banking enhance personal finances?

With D360 Digital Banking, individuals can effortlessly manage their finances, set financial goals, track spending patterns, and make informed financial decisions. The platform provides personalized insights, tailored recommendations, and budgeting tools to empower users to take control of their finances.

Question 3: How does D360 Digital Banking benefit businesses?

D360 Digital Banking streamlines business operations by providing a centralized platform for managing cash flow, paying bills, collecting payments, and accessing financial insights. It offers tailored solutions for businesses of all sizes, helping them optimize their financial processes and improve efficiency.

Question 4: Is D360 Digital Banking secure?

Security is a top priority for D360 Digital Banking. The platform employs advanced encryption technologies, multi-factor authentication, and industry-leading security measures to protect user data and transactions.

Question 5: How can I access D360 Digital Banking?

Accessing D360 Digital Banking is easy and convenient. Users can enroll online or through their mobile device and start enjoying the benefits of digital banking immediately.

Question 6: How does D360 Digital Banking compare to other digital banking platforms?

D360 Digital Banking stands out with its comprehensive suite of features, intuitive user interface, and commitment to security. It offers a tailored experience for both personal and business clients, empowering them to manage their finances effectively.

Unlock the power of digital banking with D360 Digital Banking. Experience a seamless, secure, and feature-rich platform designed to empower your personal and business finances.

For further inquiries, please consult the D360 Digital Banking: Empowering Personal And Business Finances website or contact our customer support team.

Tips

D360 Digital Banking empowers personal and business finances with its innovative solutions. Here are several tips to optimize your financial management:

Tip 1: Utilize Automated Bill Pay

Automate bill payments to streamline recurring expenses and ensure timely payments. This feature avoids late fees, preserves credit scores, and simplifies financial tracking.

Tip 2: Set Financial Goals

Establish clear financial goals, both short-term and long-term. D360's goal-setting tools assist in visualizing your objectives and tracking progress towards their achievement.

Tip 3: Monitor Cash Flow

Stay vigilant about cash flow to anticipate future financial needs. Utilize D360's cash flow management tools to monitor income and expenses, identify areas for optimization, and avoid overdraft situations.

Tip 4: Manage Expenses with Budgeting

Create a budget to control spending and align it with your financial goals. D360's budgeting features help categorize expenses, set limits, and provide insights into spending habits.

Tip 5: Secure Financial Data

Protect your financial information by utilizing D360's robust security measures. Engage strong passwords, enable two-factor authentication, and be cautious of phishing attempts to safeguard your sensitive data.

By implementing these tips, you can enhance your financial management, streamline processes, and optimize your financial health. D360 Digital Banking empowers you to make informed decisions and achieve your financial objectives.

D360 Digital Banking: Empowering Personal And Business Finances

D360 Digital Banking emerges as a progressive tool that empowers individuals and businesses to manage their finances successfully. It entails various aspects that contribute to a seamless and comprehensive banking experience.

For instance, a small business owner can leverage D360's real-time insights to monitor cash flow and make informed decisions. A personal account holder can utilize personalized budgeting tools to track expenses and plan for the future. These multifaceted key aspects empower users to make D360 Digital Banking an indispensable part of their financial lives.

D360 Digital Banking: Empowering Personal And Business Finances

Digital banking has revolutionized the way we manage our finances. D360 Digital Banking is a comprehensive platform that empowers individuals and businesses to take control of their financial lives. By providing a suite of innovative tools and features, D360 Digital Banking helps users to streamline their banking experience, make informed financial decisions, and achieve their financial goals.

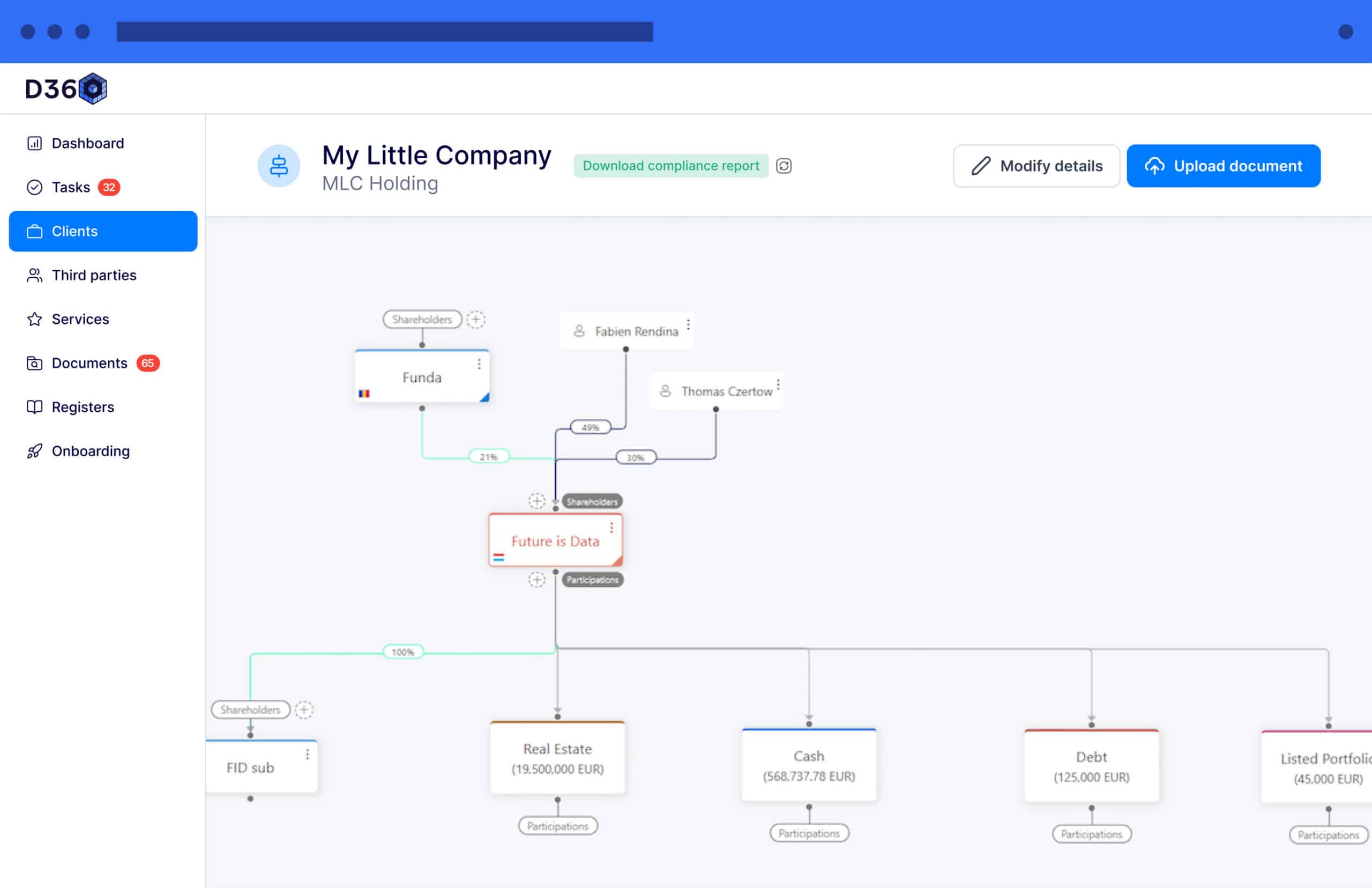

D360 | All-in-one digital solution for finance professionals - Source futureisdata.lu

For personal finances, D360 Digital Banking offers a range of features that make managing money easier and more efficient. Users can view all of their accounts in one place, track spending, set budgets, and receive alerts about upcoming bills. They can also make payments, transfer funds, and deposit checks remotely. D360 Digital Banking also provides access to a team of financial advisors who can offer guidance and support.

For businesses, D360 Digital Banking offers a range of features that streamline operations and improve cash flow. Businesses can manage multiple accounts, process payroll, pay bills, and accept payments online. They can also access a variety of financial reports and analytics to track their financial performance. D360 Digital Banking also provides access to a team of business banking specialists who can offer guidance and support.

D360 Digital Banking is an essential tool for individuals and businesses who want to take control of their financial lives. By providing a suite of innovative tools and features, D360 Digital Banking helps users to streamline their banking experience, make informed financial decisions, and achieve their financial goals.

Benefits of D360 Digital Banking:

| Benefit | Description |

|---|---|

| Convenience | Bank anytime, anywhere from your computer or mobile device. |

| Security | Protect your finances with advanced security measures. |

| Control | Manage your accounts and make financial decisions in real-time. |

| Insights | Track your spending, set budgets, and get personalized financial advice. |

| Support | Access a team of financial advisors and business banking specialists who can offer guidance and support. |

Conclusion

D360 Digital Banking is a powerful tool that can help individuals and businesses take control of their financial lives. By providing a suite of innovative tools and features, D360 Digital Banking helps users to streamline their banking experience, make informed financial decisions, and achieve their financial goals.

In today's digital world, D360 Digital Banking is a must-have for anyone who wants to manage their finances effectively. Whether you're an individual or a business, D360 Digital Banking can help you save time, money, and stress.

Tidak ada komentar:

Posting Komentar